Aegros Secures Final Funding for Completion of its 125,000 Litre Haemafrac® Facility

July 3, 2025

An Australian biotech start-up hoping to emulate the success of blood plasma giant CSL has secured a $37 million lifeline eight months after it was forced to suspend operations unable to repay mounting debts.

Staff at Aegros were stood down with pay in November when the company paused operations to search for funding. At the time, the company owed contractors and staff around $16 million. Development of a $65 million manufacturing facility expansion in Sydney has also been paused for a year.

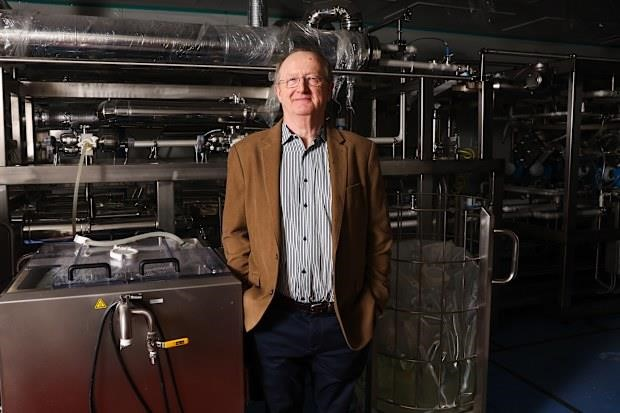

Aegros investor Ray Nolan says a management overhaul will help put the company on the path to commercial success.

But an investment syndicate led by property developer Ray Nolan, who first bought into Aegros almost two years ago, has tipped $20 million into the business. Another $17 million has been raised from clients of corporate adviser, STK Markets, and others.

A $15 million loan has also been secured against research and development cash rebates, and the company could borrow another $5 million against the proceeds of the government scheme in the next financial year.

Founded in 2017 by haematologist Hari Nair and biotech entrepreneur John Manusu, Aegros is attempting to commercialise a blood plasma fractionation technology called HaemaFrac which has been in development since the 1980s. It is designed to significantly boost the yield of immunoglobulin – used to treat a range of medical issues – from plasma.

But the business has struggled with a shortfall of cash. It was not sufficiently funded to complete the $65 million construction of its expanded Macquarie

Park facility and former staff have told The Australian Financial Review about missed payroll cycles dating back to 2021 and occurring frequently in the years since. Last year, it was subjected to several windingup actions by disgruntled creditors.

When Nolan bought into the business, he acquired the shares of an exiting shareholder for about half their then price.

The most recent investment in June, which should fund the completion of the manufacturing expansion and help the company stay afloat until it receives regulatory approvals for its treatment, was priced at $1 per share – a hefty discount on a April last year, when stock was $18 apiece.

“The wheels came off … we saw a unique opportunity to take what, I believe, is first-rate Australian technology, developed by a company that needs some help,” Nolan said.

“We recognised there were certain weaknesses in the company we had to address – one was lack of capital, commercial leadership and a clear strategy.

“My role here is not about the science. It has long demonstrated its underlying technology works and its product quality meets a very high standard… what the company needs now is not another scientific validation, it needs commercial direction, fiscal discipline and execution of our plan.”

“There’s a new leadership structure in place … there’s a new sheriff in town.” – Ray Nolan, property developer

As part of the funding deal, Nair and Manusu have resigned from day-today roles within the business, but are staying on as non-executive directors. Damian Thornton, head of Aegros’ therapeutics and engineering division, has been made acting chief executive, with the expectation he will shortly be appointed to the role permanently.

Staff returned to work on Monday, having received eight months of unpaid wages over the weekend, thanks to the fresh funding.

“We have a clear, focused plan … to take this to revenue [through] hyperimmunes,” Nolan said, adding that there was a “new sheriff in town” after the management overhaul.

Passive immunity against certain diseases

Hyperimmune therapies are plasma-based therapies that contain high levels of specific antibodies to provide passive immunity against particular diseases, such as COVID-19. The business has previously conducted a COVID-19 hyperimmune trial.

Barring regulatory or building delays, Nolan said he was confident the Macquarie Park facility would be completed and the business would generate revenue within 12 months.

In June, Aegros staff were asked to sign a deed of agreement as a condition of returning to work, which was clumsily worded and gave them the impression that only superannuation would be repaid.

It also asked them to release Aegros and its directors, employees, assignees or successors from “any liability past, present, or future from all claims, suits, demands, actions or proceedings arising out of or connected with the late payment of salary”, and to not make any disparaging remarks about the business.

Following inquiries from the Financial Review, the business committed to pay staff all their entitlements. Nolan said that had always been the intention. The agreement has not been mentioned again since all current and former staff have received their full pay.

Some Aegros staff will be made redundant this week as the new management cuts costs and outsources its finance, Human Resources and technology functions.

The company claims to have more than 700 investors, including

Indigenous-owned investment company Fresh Start Australia, which is one of its largest backers. L39 Capital, a private wealth manager founded by Mark Garkawe, is also an investor, as are many individuals in the medical field.

When asked where the company would be in three years, Nolan said he was focused only on the next 12 months. “I think there [have] been enough people in Aegros previously looking over the horizon,” he added.